Nos importa verte sonreír

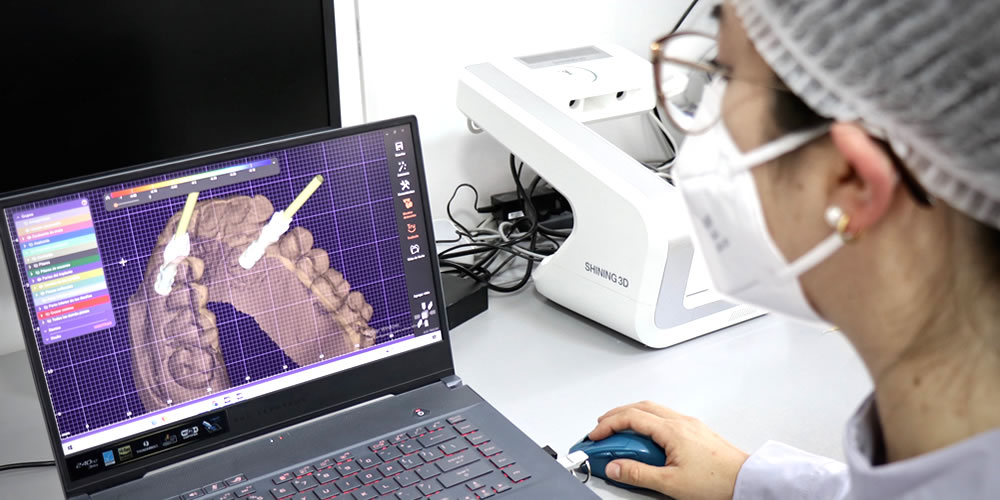

Laboratorio dental

Contamos con todas

las especialidades odontológicas

Más de 30 años al cuidado de tu sonrisa:

En Centro Dental San José trabajamos siempre buscando el bienestar de nuestros pacientes, ofrecemos servicios de calidad que buscan siempre ir a la par con los nuevos desarrollos tecnológicos garantizando así una atención de primera.

Nuestras alianzas estratégicas con todas las compañías de seguros y empresas prestadoras de salud permiten a nuestros pacientes utilizar nuestros servicios en todas nuestras sedes de Lima y provincia.

Nuestras especialidades

Lima

Lima

- San Borja

- San Isidro

- Bellavista/Callao

- Los Olivos

- San Miguel

Sede San Borja

Dirección:

Av. Géminis E-27 Urb. Papa Juan XXIII

Teléfono:

225-9510 / 224-2438/ 226-1266/ 946-033-317/ 988-680-854/

Horarios de atención:

Lunes a Viernes de 9:00 am a 9:00 pm

Sábados de 9:00 am a 7:00 pm

Sede San Isidro

Dirección:

Av. Las Camelias N°741-B 3º piso

Teléfono:

422-8306 / 222-8911 / 946-036-640 / 922-539-074

Horarios de atención:

Lunes a Viernes de 9:00 am a 9:00 pm

Sábados de 9:00 am a 7:00 pm

Sede Bellavista/Callao

Sede Los Olivos

Provincia

- Arequipa

- Cuzco

- Paita

- Trujillo

- Huaraz

- Cajamarca

- Ica

Sede Arequipa

Dirección:

Av. Abelardo Quiñónez B-5 Urb. Magisterial II etapa, Umacollo - Yanahuara

Teléfono:

054-259669 / 999-910-206

Horarios de atención:

Lunes a Viernes 09:00 am – 01:00 pm y de 04:00 pm – 09:00 pm

Sábados de 07:00 am – 03:00 pm

Sede Paita

Sede Trujillo

Dirección:

Av. Húsares de Junín 590 Urb. La Merced

Teléfono:

044-7544301 / 967-947-125

Horarios de atención:

Lunes a Viernes de 09:00 am – 01:00 pm y de 04:00 pm – 09:00 pm

Sábados de 09:00 am – 01:00 pm y de 04:00 pm – 07:00 pm

Sede Huaraz

Dirección:

Jirón Simón Bolívar N°794

Teléfono:

43-424497 / 943-771-915

Horarios de atención:

Lunes a Viernes de 08:30 am – 01:00 pm y de 03:30 pm – 09:00 pm

Sábados de 08:30 am – 01:00 pm y de 03:30 pm – 09:00 pm

Sede Cajamarca

Dirección:

Jr. Los Sauces Nº 415 Urbanización Los Rosales

Teléfono:

076-343693

Horarios de atención:

Lunes a Viernes de 09:00 am – 01:00 pm y de 03:30 pm – 09:00 pm

Sábados de 09:00 am – 01:00 pm y de 03:30 pm – 09:00 pm

Sede Ica

Dirección:

El Parque N° 153, Urb. Residencial La Angostura

Teléfono:

056-257755 / 965-445-637

Horarios de atención:

Lunes a Viernes de 09:00 am – 01:00 pm y de 03:00 pm – 09:00 pm

Sábados de 09:00 am – 01:00 pm y de 03:00 pm – 07:00 pm

Nuestros convenios